Success Needs A Plan Of Action

Building wealth is a lot easier when you have an investing strategy. But before you choose a strategy that works for you, it helps to know what tools you have to work with. You don’t build a house with just a hammer.

Here’s a simplified list of 5 different investing strategies to explore and consider.

- Diversification through ETFs or Mutual Funds

- Value Investing

- Growth Investing

- Momentum Investing

- Income Investing

Maybe one, or more of them fits in your portfolio?

Diversification Through ETFs and Mutual Funds

ETF stands for Exchanged Traded Fund. This is when you buy various stocks (also commonly referred to as a basket of stocks) all represented in 1 share of the ETF. It’s similar to a mutual fund but with the benefits that ETFs are more likely to be passive (no manager picking and choosing stocks) resulting in lower fees, and you can buy them anytime during market hours — similar to stocks (whereas mutual funds are purchased at the end of the day and the price is averaged for the range that day).

Some common examples of this are Vanguard ETFs:

- VTI – Vanguard Total Stock Market Index – which tracks the performance of the US stock market and includes over 3600 companies like Apple, Amazon, Facebook, Alphabet, Microsoft, Tesla, Johnson and Johnson, Visa, etc.

- VOO – Vanguard S&P 500 ETF – which tracks 500 of the biggest companies in the United States (tracking the S&P 500 index).

- BND – Vanguard Total Bond Market ETF – which tracks a broad bond index of around 10,000 bonds consisting of U.S. Government bonds, AAA, AA, A, BBB bonds.

There are plenty of other ETFs tracking everything from alternative energy and solar to microchips to commodities to REITs and so on. Broad market US based index funds are often considered some of the most passive, low fee, and low-risk ways to grow your money over time. While you won’t see the returns that putting all your money into Tesla or bitcoin at the beginning stages would have gotten you — if you’re looking for a simple, low-fee, diversified (and therefore generally safer) way to invest, consider looking at ETFs.

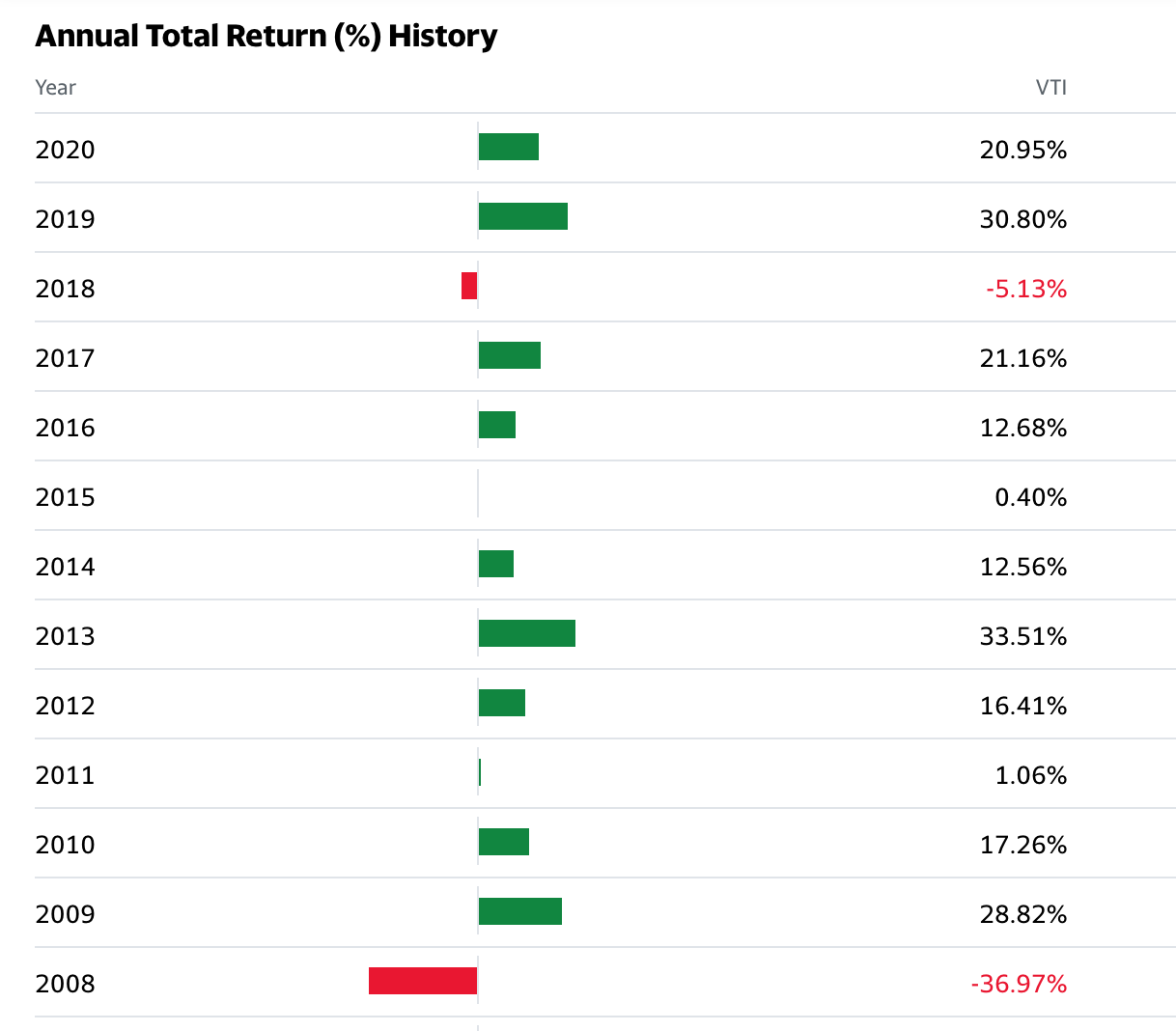

A good comparison to consider for this is that most banks will pay interest of about 1% – 2% a year or less on a savings account, while an ETF like VTI has returned the following according to Yahoo.com.

Value Investing

Value investing is a strategy that focuses on picking stocks believed to be trading for less than their true value and waiting for them to correct or adjust higher to that share price. The opposite of this exists as well, where stocks are overvalued and can be shorted if the investor believes the share price will drop. Deciding their true value is likely the most difficult part of this strategy.

There are however, many reasons you can find investments that are valued incorrectly by the market. Here are some examples a stock might be undervalued:

- World events may bring fear and paranoia to the market resulting in a drop in share price. Once the event passes, share price could rise again.

- Companies may have a bad earnings quarter and the marketplace overreacts to this information. — Investors can be jumpy. But companies with good management have a team of people working daily to overcome issues and “right the ship.”

- There could be a scandal involving the company or someone in the company resulting in bad publicity and causing a short-term drop in share price but in the long-term this event might not affect overall sales/revenue.

- A company’s product is not yet fully understood and the true significance of their business is underestimated.

An example of a company being overvalued can be found in trend/meme stocks.

- If everyone on social media is piling into a stock cause that’s what everyone is pushing (to the moon), the true value of the company/product/sales may be ignored and the share price may skyrocket to a place that has no logical foundation. If you’re buying into the stock at those times, don’t be surprised if the shares correct lower and you lose money. You never truly considered the company’s value and were simply buying on the excitement of the masses.

The goal is to try and understand when and why a company is being valued wrong and put your money into that stock knowing it’s only a matter of time before others realize it’s true value and the share price corrects.

Growth Investing

Growth Investing looks to invest in stocks that are still young or in the earlier phases of their business cycle. Newer companies that haven’t reached their full potential can offer a large return as they surge in popularity and find their place in the world market. Just imagine buying Amazon or Tesla when they first went public.

- Amazon – IPO – 1997 – $18 a share.

- Tesla – IPO – 2010 – $17 a share.

Momentum Investing

Momentum investing seeks to follow the trend. If a stock or sector has been heading up lately, some believe it’s worth getting in to continue riding that wave or direction.

Income Investing

Income investing is the goal to build a set of investments that can pay out regularly to help replace a paycheck from job labor. Some examples of this are:

- Dividends from stocks – These usually pay quarterly although some do pay monthly.

- Bonds – By loaning your money to a company or the government you can receive back interest payments as well as the original amount you invested at the end of the loan term.

- Real Estate – Collecting rent from tenants or owning REITS that pay out a portion of those rents in the form of dividends.

It’s important to know all your options and find out what kinds of tools and strategies people are following so you can adjust your plan accordingly. Different strategies may be beneficial at different phases of your investing timeline. Are there any you would consider currently, or is your approach different?