Simple Interest VS Compound Interest

What Is Interest When We’re Talking About Money?

Have you ever had to pay interest? Maybe on your credit card? You know how each month they try to charge you a few extra dollars on top of the original amount if you don’t pay it off? Basically they’re getting free money from you right? In that situation we’re not big fans of interest (i.e. the amount extra we have to pay as a charge over the initial cost of borrowing money).

But there are other situations too, good situations. For example, let’s say you loan someone money for 3 months, and charge 5% interest because of the hassle of loaning them the money. Now YOU are getting the free money.

Do you like free money? Say hello to compound interest.

All you have to do is learn to scale and expand the interest system and you’ll have bigger and bigger amounts coming back to you. One way to do that is through compound interest and investing.

What Is Compound Interest?

Compound interest is like when your interest goes to the gym. It starts small at first, but the more it goes, the bigger and bigger it gets.

Have you ever heard of the snowball effect?

A snowball starts small but rolls down a hill and the farther it goes, the more it grows. It adds a layer each time it rolls a full circle. Those layers build on one another, picking up more and more snow each time.

With compound interest, you’re getting interest on any previous interest every time interest is paid. Yeah, that’s a lot of interest.

So depending on the length of time and the compounding frequency (how often the interest is payed out), the amount can grow quite large without more effort from you.

Example – I loan you 100 dollars for one month. You have to pay me back the 100 dollars plus 10% interest every week.

If it’s simple interest, it looks like this:

Week 1, 2, 3, 4 – 100 x .10 = 10 — So every week you give me 10 dollars plus the original 100 at the end of the month.

If it’s compound interest, then the current week’s interest is based on the previous amount added to the total, so it looks like this:

Week 1 – 100 x .10 = 10 –> New total interest will be based on = 110

Week 2 – 110 x .10 = 11 –> New total interest will be based on = 121

Week 3 – 121 x .10 = 12.1 –> New total interest will be based on = 133.1

Week 4 – 133.1 x .10 =13.31 –> New total interest will be based on = 146.41

Look At Those Curves!

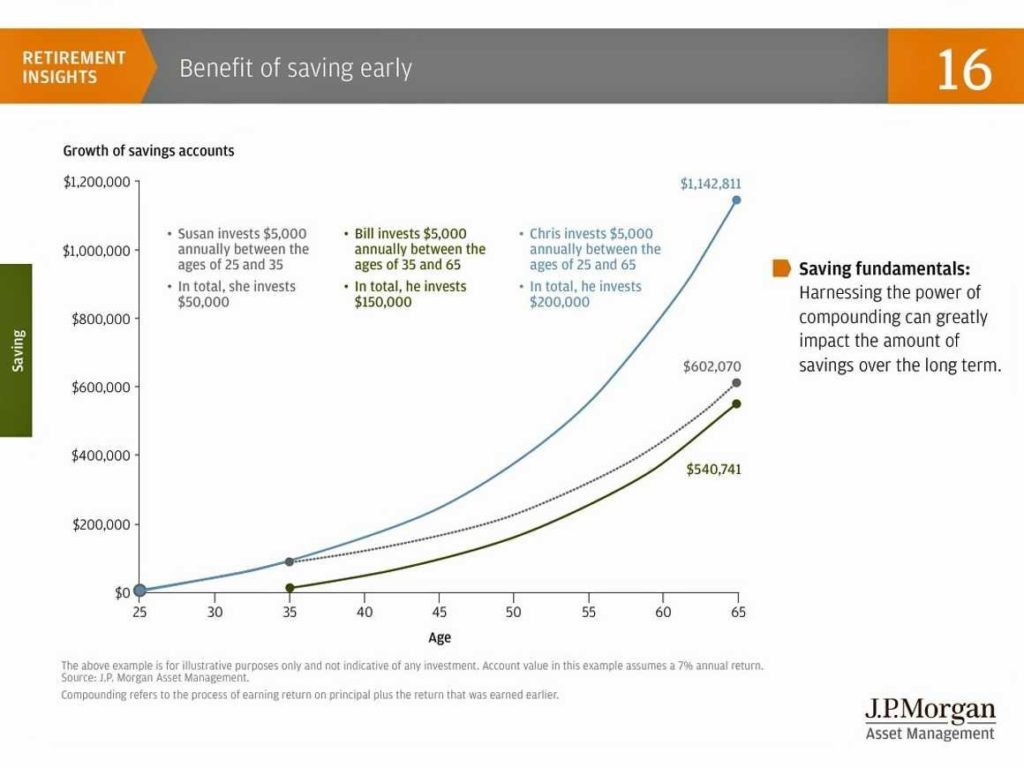

Luckily J.P. Morgan worked up a graph showing the benefits of compound interest over time for us, thanks guys. There are certain points not considered here, like what the interest rate or return is, which can make a huge difference. But the message is clear; the more time you give to allow compound interest to work it’s magic, the greater the results.

Another thing I’d highlight about the graph above is that it uses the word savings at the top. But a quick look at the interest paid on most savings accounts (.01% to .06%) makes it clear that the interest rate most banks give us can’t even compare to the returns we can get through investing in stocks, real estate, business and other assets. That being said, the point is to start early and let your money work for you over longer periods, and the results will be much larger.

Every moment you wait to start, you’re hurting yourself more than you can imagine. You’re magnifying the opportunity cost of waiting and losing out on large sums of money. Be aware of how much time you have.

How Can Compound Interest Make You Rich?

All it takes is a little foresight and planning to start building your wealth. How far ahead can you look? Start as soon as possible and put compound interest to work for you.

Here’s a story from Dave Ramsey to further highlight the benefits of long term compound interest if you don’t believe me yet.

If you have any great stories about compound interest please share in the comments.

Examples are powerful and great motivation for everyone, we’d love it if you’d share yours with us.

Pingback: Time Is Your Most Important Resource – Don’t Waste It – Growth Money Mindset

Pingback: Choose A "Growth Money Mindset" To Level Up - Growth Money Mindset